Why We Care What the Federal Reserve Says

- William Hubbard

- Sep 2, 2025

- 3 min read

Fed Chair Jerome Powell recently spoke at an important meeting and hinted that interest rates will likely be cut in September. He said the Fed needs to balance two things: keeping inflation under control and protecting jobs. Stock markets have been hitting record highs, which shows investors feel good about the Fed's plans and the economy. What do these possible rate cuts mean for people investing for the long term?

Why investor trust in the Fed matters

When investors trust the Fed, it helps the Fed's policies work better. The Fed controls short-term rates, but longer-term rates (like mortgage rates) are set by markets. This means the Fed's plans only work when investors believe the Fed can reach its goals.

In the 1970s, investors lost trust in the Fed when prices rose too fast. Bond investors demanded higher returns to protect against inflation risk. But after 2008, the Fed kept inflation expectations steady because investors trusted them. Even when inflation rose after the pandemic, the Fed's quick action helped restore confidence.

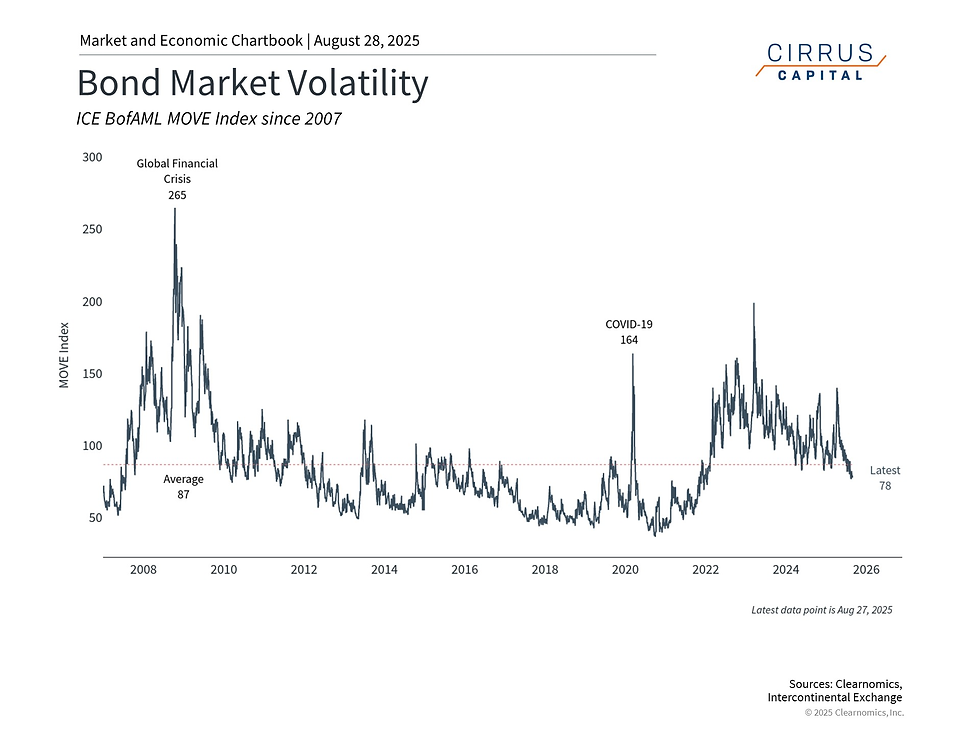

One way to measure confidence is through corporate bond yields. These are the interest rates companies pay to borrow money. Yields fall when the economy is healthy and companies are making good profits. They rise when investors worry about the economy.

Today's markets show strong confidence. Corporate bond yields and spreads (the extra return above safe government bonds) are at their lowest levels in years. This means investors feel comfortable lending to companies, which matches the stock market hitting new highs.

The Fed is planning rate cuts

Powell's speech showed the Fed must balance controlling inflation with supporting jobs. He noted that tariffs could push inflation higher, but also worried about job market weakness.

Recent data shows this challenge. The Fed's preferred inflation measure rose 2.6% over the past year, above their 2% target. But job growth has slowed dramatically. July added only 73,000 new jobs, much less than expected. Unemployment has stayed between 4.0% and 4.2%, but fewer people are looking for work.

The Fed must decide if tariff-related price increases are temporary or signal bigger inflation problems. Right now, they seem ready for careful rate cuts.

Rate cuts create bond opportunities

Fed rate cuts have important effects for all investors. When rates fall, existing bonds with higher yields become more valuable. This has helped the U.S. bond market return 4.8% this year.

Bond yields are attractive right now. Treasury bonds yield 4.0%, investment grade corporate bonds yield 4.9%, and high yield bonds yield 6.9%. These are much higher than average levels since 2008.

For stock investors, lower rates reduce company borrowing costs, which can boost growth and stock prices. The market's recent highs suggest investors are already preparing for this.

However, when corporate bond spreads are tight and stock valuations are high, investors should stay disciplined. Tight spreads mean corporate bonds may offer limited returns if conditions worsen. High valuations can also mean lower long-term returns.

The bottom line? Market confidence in Fed policy and strong company fundamentals create opportunities for long-term equity investors. More certain monetary policy can help investors weigh the balance between stocks and bonds that best suits their own risk preferences. Reach out today to learn more about how we help investors think about and manage risk.

Disclosure:

Any views expressed are those of the author(s) and do not necessarily reflect the views of Cirrus Capital LLC. The content on this site is for informational purposes only and should not be considered investment advice or a recommendation regarding any security or strategy. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Cirrus Capital LLC is an SEC-registered investment adviser; registration does not imply any particular level of skill or training. Advisory services are offered only pursuant to a written agreement and only in jurisdictions where legally permitted. See our Form ADV Part 2A and Form CRS for important disclosures. Contact me for further information.

Comments